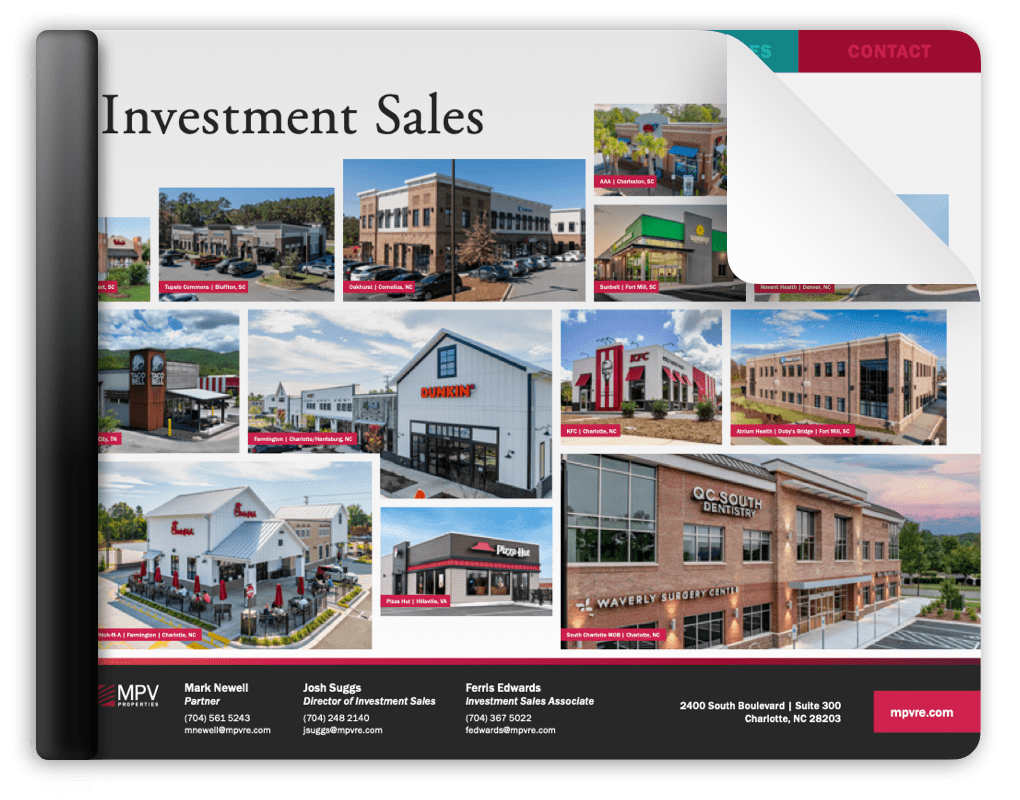

Investment Sales

Creating value.

MPV Properties’ Investment Sales Team specializes in the sale of retail, single tenant NNN, office, and medical office income producing properties. Our goal is to meet our client’s investment sales objectives by achieving the best possible value within the desired timeframe. MPV leverages its vast investor/buyer database and extensive market knowledge to achieve optimal sales values.

Over $730MM Sales Volume

Over 3MM Sq.Ft. Sold

Founded in 2010

Our Investment Sales Team:

- Analyzes the property, rent roll, and leases to establish value in the context of market cap rates and works with the seller to arrive at a price that meets the sale objective

- Prepares a thorough investment offering memorandum

- Presents marketing materials including the use of our investor database, an extensive compilation of regional and national investors

- Qualifies the prospects

- Negotiates the contract

- Manages the due diligence and closing process

Buy

Acquisition

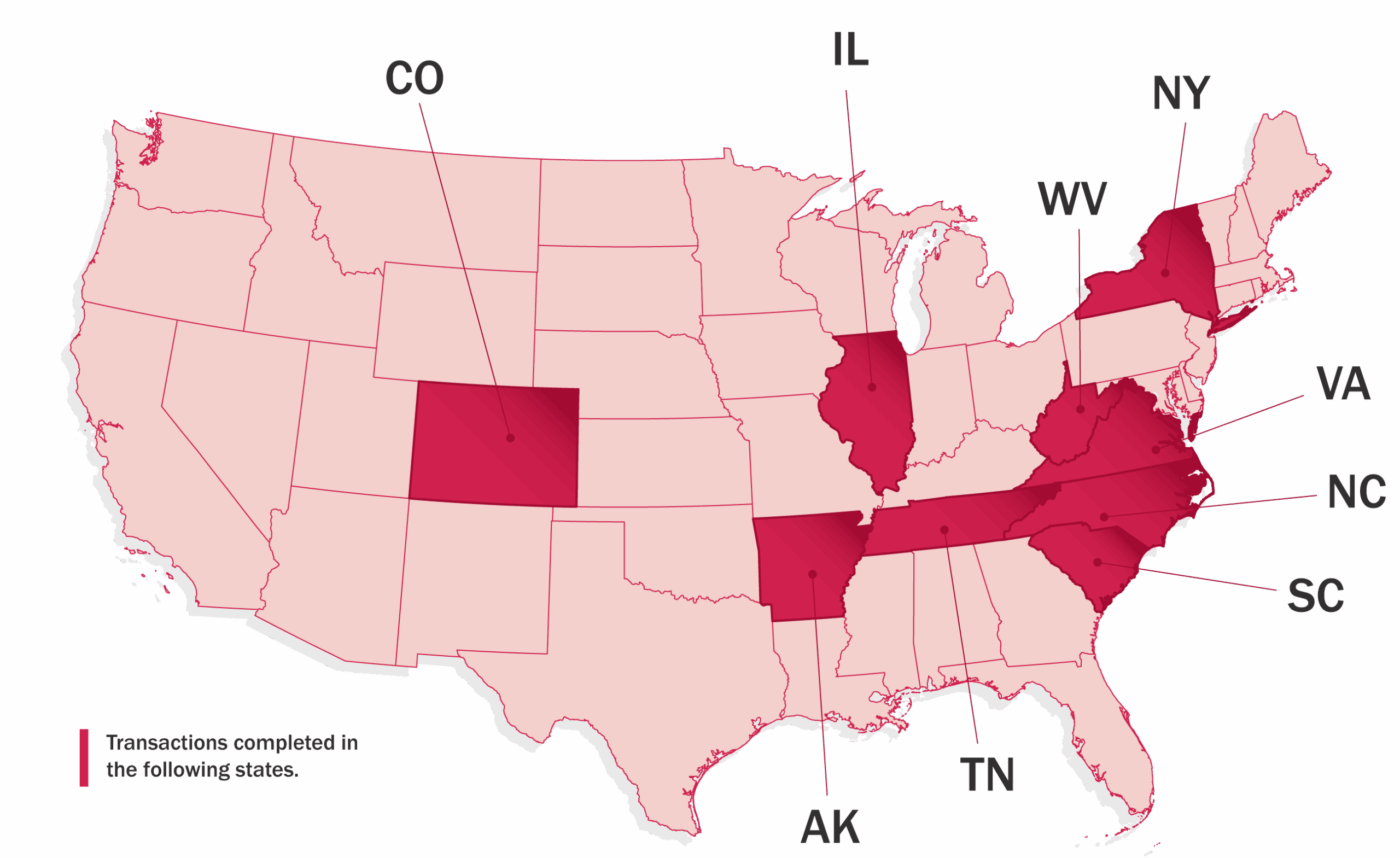

MPV leverages deep market knowledge and proprietary research to identify hight-performing retail and medical investment opportunities across the Carolinas and Southeast. Our team provides clients with real-time insights, strategic underwriting, and access to exclusive off-market deals.

Sell

Disposition

With a proven track record of maximizing value, MPV guides owners through every stage of the disposition process. Our institutional-quality marketing, targeted buyer outreach, and boots-on-the-ground execution ensure assets achieve maximum exposure and optimal pricing.

1031

Exchange

1031 Exchange

MPV specializes in helping investors navigate the complexities of 1031 deferred tax exchanges. From identifying replacement properties to coordinating tight deadlines, our team provides seamless execution that preserves equity and positions portfolios for long-term growth.

Unlock Capital

Sale-Leaseback

Our sale-leaseback advisory unlocks capital for owners while delivering long-term occupancy solutions. MPV structures transactions that meet both corporate real estate objectives and investor demand, aligning operators with stable credit-backed buyers.